General

Consumer Rights Act 2015: Enhancing Fairness in Commerce

In October 2015, the United Kingdom implemented the Consumer Rights Act, a landmark legislation aimed at bolstering consumer rights and providing clarity in an ever-evolving marketplace. This comprehensive act covers a wide range of issues, from faulty goods to digital content, unfair contract terms, non-competitive business practices, and the facilitation of Alternative Dispute Resolution (ADR) for businesses. This article explores the key provisions of the Consumer Rights Act 2015, delving into its impact on consumer protection, the digital landscape, and the enforcement of fair business practices.

Clarity and Understanding:

One of the primary objectives of the Consumer Rights Act 2015 was to make consumer rights more transparent and accessible. By consolidating and simplifying existing laws, the act sought to empower consumers with a clearer understanding of their rights when engaging in commercial transactions. This move towards greater transparency not only benefits consumers but also aids businesses in understanding their obligations, fostering a fair and balanced marketplace.

Coverage of Key Issues:

The Act covers a spectrum of issues critical to consumer welfare. Among these, addressing faulty goods stands out as a cornerstone of consumer protection. The legislation strengthens consumers’ rights by clearly outlining the recourse available when purchased goods do not meet the expected standard of quality. This provision acts as a deterrent to manufacturers and retailers, encouraging them to uphold higher standards in product quality and safety.

Digital content has become an integral part of modern consumer transactions. The Consumer Rights Act 2015 introduces new rights specifically tailored to digital content, recognizing the unique challenges and considerations in this rapidly expanding market. This ensures that consumers are protected when engaging with digital products, services, or content, contributing to the overall confidence in digital transactions.

Unfair terms in contracts have long been a concern for consumers. The Act addresses this issue by providing a framework for evaluating and challenging unfair terms. This empowers consumers to assert their rights when faced with contracts that may be skewed in favor of businesses, promoting fairness and equity in contractual agreements.

Regulation of Business Practices:

Non-competitive business practices are a threat to fair competition and can harm consumers by limiting choices and driving up prices. The Consumer Rights Act 2015 equips public enforcers with the tools needed to address such practices effectively. Written notice for inspections by public enforcers enhances transparency and accountability, ensuring that businesses operate within the bounds of fair competition.

The Act also provides greater flexibility for public enforcers to respond to breaches of consumer law. This adaptability enables regulatory bodies to address emerging challenges and swiftly respond to evolving trends, maintaining the integrity of consumer protection in a dynamic marketplace.

Digital Content and Service Provision:

In an era dominated by digital transactions, the Consumer Rights Act 2015 recognizes the need for specific regulations tailored to digital content. The Act introduces clear rules for service provision, establishing a framework that promotes fairness and accountability in the rapidly growing digital economy. This is particularly crucial in ensuring that consumers receive the services they expect and are protected from deceptive practices in the digital realm.

Alternative Dispute Resolution:

The inclusion of Alternative Dispute Resolution (ADR) as an option for businesses and consumers is a noteworthy feature of the Consumer Rights Act 2015. ADR provides an alternative to traditional legal proceedings, offering a quicker and often more cost-effective means of resolving disputes. While not mandatory in certain sectors, the availability of ADR empowers businesses and consumers alike to seek resolution through a neutral third party, contributing to a more efficient and accessible justice system.

Conclusion:

The Consumer Rights Act 2015 represents a significant step forward in enhancing consumer protection and promoting fairness in the marketplace. By addressing key issues such as faulty goods, digital content, unfair contract terms, and non-competitive business practices, the Act provides a comprehensive framework that adapts to the challenges of the modern economy.

The emphasis on clarity and understanding, coupled with the recognition of the unique challenges posed by digital transactions, demonstrates a commitment to evolving with the times. As businesses and consumers navigate an increasingly complex landscape, the Consumer Rights Act 2015 serves as a guidepost, fostering a culture of fairness, transparency, and accountability that benefits all stakeholders in the marketplace.

General

The Mating Press Position and its Role in Sexual Wellness

missionary position, involves the male partner assuming a more assertive and dominant role during sexual intercourse. While the missionary position typically features the male partner on top, the Mating Press introduces a heightened sense of aggression, creating a unique dynamic between partners. It is crucial to note that engaging in any sexual activity should be consensual, with open communication between partners to ensure a positive and enjoyable experience.

Physical Mechanics and Dynamics:

Exploring the physical mechanics of the Mating Press position involves understanding the nuances that differentiate it from the traditional missionary position. The position often includes variations in the angle and depth of penetration, providing a different sensory experience for both partners. This physicality may contribute to increased arousal and satisfaction, but it is essential for individuals to be aware of their comfort levels and communicate openly about their desires.

Potential Benefits of the Mating Press Position:

- Variety and Novelty:

The Mating Press position can introduce variety and novelty into sexual relationships, preventing monotony and enhancing overall satisfaction. Experimenting with different positions can contribute to a more fulfilling and exciting intimate connection between partners. - Enhanced Emotional Connection:

Sexual intimacy plays a crucial role in fostering emotional connections between partners. The Mating Press position, with its unique dynamics, may deepen the emotional bond by allowing couples to explore new facets of their relationship. - Increased Physical Stimulation:

The altered mechanics of the Mating Press position can lead to increased physical stimulation for both partners. This heightened sensation may contribute to a more intense and pleasurable sexual experience.

Communication and Consent:

While exploring different sexual positions can be an exciting aspect of a relationship, it is imperative to prioritize communication and consent. Openly discussing desires, boundaries, and comfort levels with a partner is crucial to creating a safe and trusting environment. Consent should be enthusiastic, continuous, and mutual, ensuring that both individuals feel respected and comfortable throughout the intimate encounter.

Potential Concerns and Considerations:

- Physical Comfort and Fitness:

Engaging in more assertive positions, such as the Mating Press, may require a certain level of physical fitness and flexibility. It is essential for individuals to be mindful of their bodies and communicate any discomfort or limitations to their partners. - Emotional Comfort:

Experimenting with new sexual positions can evoke a range of emotions. Partners should be attentive to each other’s emotional well-being and provide support and reassurance as needed.

Conclusion:

The Mating Press position represents one of the many variations in the spectrum of human sexuality. As with any sexual activity, open communication, trust, and consent are paramount to ensuring a positive and enjoyable experience for both partners. Exploring different positions, including the Mating Press, can add excitement and variety to intimate relationships, deepening the emotional connection and enhancing overall satisfaction. It is crucial for individuals to approach sexual experimentation with a mutual understanding of boundaries and a commitment to each other’s well-being. As society continues to evolve, conversations around sexual wellness and exploration become increasingly important, emphasizing the significance of respecting individual preferences and fostering healthy.

General

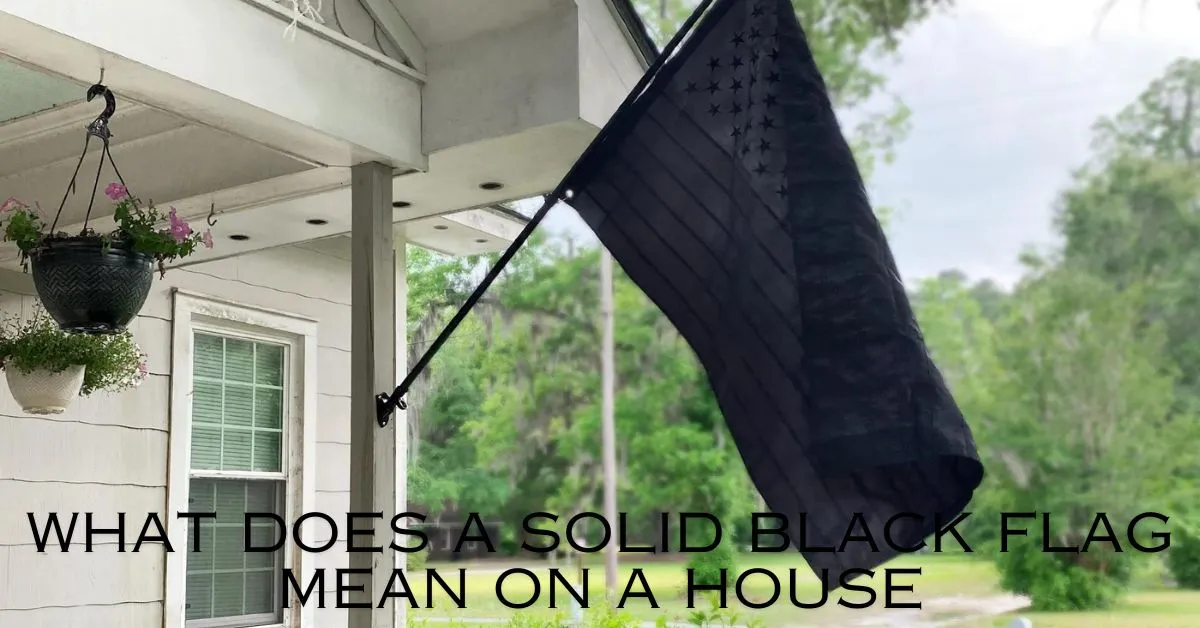

What Does a Solid Black Flag Mean on a House?

In the realm of symbolism, flags serve as powerful communicators of messages, values, and identities. They flutter proudly atop buildings, ships, and even homes, conveying a myriad of meanings. Among the vast array of flags, one might come across a peculiar sight: a solid black flag adorning a house. What could this enigmatic symbol signify? Let us delve into the depths of symbolism to uncover the potential meanings behind the presence of a solid black flag on a house.

The Intriguing Aura of the Black Flag:

Traditionally, flags have been utilized to symbolize nations, organizations, or causes, with each color and design carrying its own significance. However, the presence of a solid black flag on a house veers away from these conventional uses, inviting speculation and curiosity.

Black, as a color, has long been associated with various meanings across different cultures and contexts. Often symbolizing darkness, mystery, or mourning, it carries a sense of solemnity and gravity. When applied to flags, black can take on additional connotations, ranging from rebellion to specific messages of distress or protest.

Historical Context: The Jolly Roger and Beyond

One of the most iconic uses of the black flag is found in the infamous Jolly Roger, the traditional flag of European and American pirates. Featuring a white skull and crossbones atop a black background, the Jolly Roger struck fear into the hearts of sailors and coastal inhabitants during the age of piracy. Its message was clear: danger, lawlessness, and a disregard for authority.

Beyond piracy, black flags have been employed by various groups throughout history to signal defiance, rebellion, or mourning. During periods of political upheaval or revolution, black flags might fly high as a symbol of resistance against oppressive regimes. Similarly, in times of mourning or tragedy, black flags may be raised to express grief and solidarity.

Modern Interpretations: Contemporary Uses of the Black Flag

In contemporary contexts, the meaning of a solid black flag on a house can vary widely, depending on the intentions of the individual or group displaying it. While some instances may harken back to historical symbolism, others may take on entirely new meanings shaped by modern circumstances and ideologies.

One potential interpretation of a black flag on a house is as a symbol of protest or dissent. In an era marked by social and political tensions, individuals or communities may choose to fly black flags as a visual statement of opposition to perceived injustices or grievances. Whether advocating for environmental causes, human rights, or systemic change, the black flag can serve as a powerful emblem of resistance.

Moreover, the presence of a black flag on a house may also indicate a state of mourning or remembrance. In times of personal loss or community tragedy, displaying a black flag can express solidarity with those who are grieving and serve as a visible reminder of the need for compassion and support.

Potential Interpretations and Meanings

Despite its ominous appearance, the solid black flag on a house is not necessarily indicative of malevolent intent. Rather, its meaning is shaped by the context in which it is displayed and the message intended by those who raise it.

For some, the black flag may represent a call to action, urging society to confront pressing issues and work towards positive change. It may serve as a reminder of the complexities of the human experience, encompassing both struggle and resilience in the face of adversity.

In other instances, the black flag may serve as a beacon of solidarity and empathy, fostering connections within communities and offering solace to those in need. Its presence can signify a willingness to confront difficult truths and support one another through times of hardship.

Conclusion: Unraveling the Mysteries of the Black Flag

In the tapestry of symbols that adorn our world, the solid black flag on a house stands out as a potent emblem of meaning and significance. Whether invoking the swashbuckling adventures of pirates or the solemnity of mourning, its presence commands attention and invites interpretation.

While the exact meaning of a black flag on a house may elude easy categorization, its symbolism remains deeply rooted in history, culture, and human experience. Whether signaling defiance, mourning, or solidarity, the black flag serves as a reminder of the complexities of our shared journey and the myriad ways in which we seek to navigate its challenges.

So, the next time you encounter a solid black flag fluttering in the breeze, take a moment to ponder its significance. Behind its enigmatic facade lies a rich tapestry of meanings, waiting to be unraveled and understood.

General

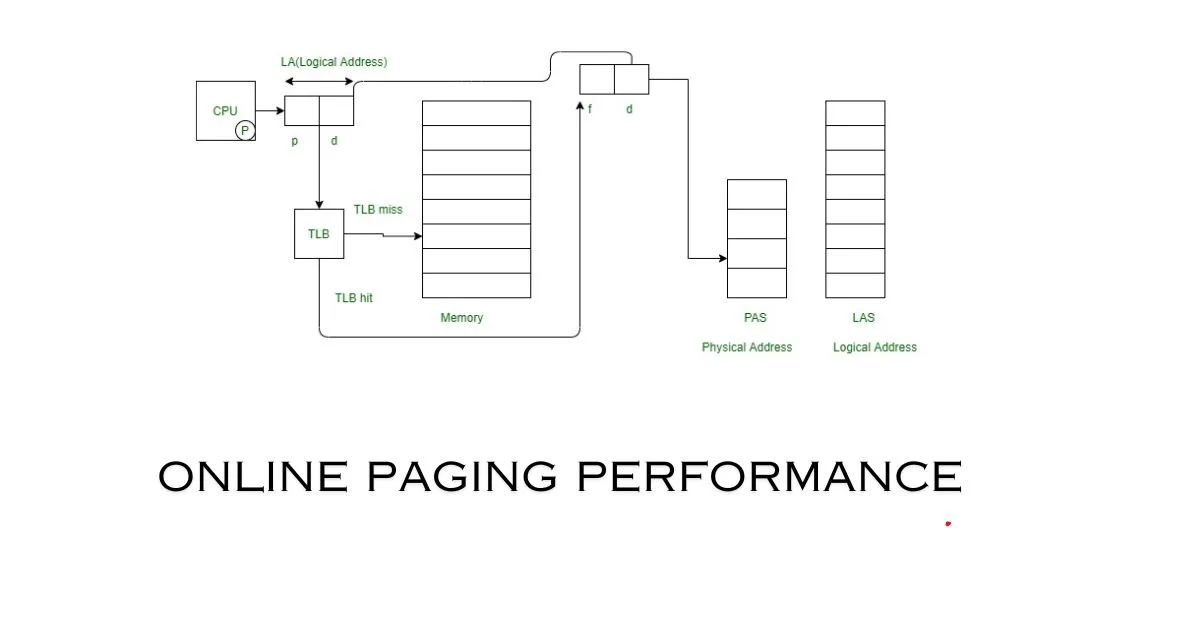

Online Paging Performance: Strategies, Tips, and Best Practices

-

Technology8 months ago

Technology8 months ago社工库: Navigating the Depths of Social Engineering Databases

-

News6 months ago

News6 months agoFinding the Truth Behind a Trails Carolina Death

-

Education7 months ago

Education7 months agoFortiOS 7.2 – NSE4_FGT-7.2 Free Exam Questions [2023]

-

Technology3 months ago

Technology3 months agoAmazon’s GPT-55X: A Revolutionary Leap in AI Technology

-

History & Tradition9 months ago

History & Tradition9 months agoλιβαισ: Unraveling Its Mystique

-

Education8 months ago

Education8 months agoExploring the Significance of 92career

-

News8 months ago

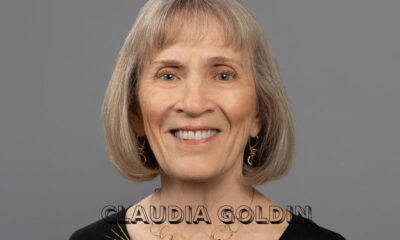

News8 months agoClaudia Goldin: A Trailblazer in Understanding Gender Pay Gap

-

Entertainment7 months ago

Entertainment7 months agoFree Tube Spot: Your Gateway to Endless Entertainment