General

Demystifying Tax Preparation – How Professional Tax Services Can Benefit You

Filing taxes is a complicated and time-consuming task. Professional tax services can help reduce mistakes and ensure compliance.

They can also unearth deductions and credits you may not have been aware of. It can save you money in the long run.

It’s essential to choose the right provider for your needs. Look for a company with a strong reputation and extensive experience in complex tax situations.

Accuracy

Tax preparation is a complicated process, and errors can be costly. Professional tax services provide accurate filings that are error-free, saving taxpayers time and money. In addition, they stay up-to-date on the TurboTax coupons, ensuring that taxpayers take advantage of all available deductions and credits.

Providing exceptional client service is a critical element in any business, and it’s essential in a service-based industry such as tax preparation. A good tax preparation company will have a dedicated customer support team to handle clients’ questions or concerns. They will also utilize technology to improve efficiency, such as secure online platforms for document sharing and electronic filing options.

When choosing a tax preparation service provider, choosing one with a strong reputation and positive reviews is essential. When selecting a provider, ask for recommendations from friends and family. You can also read online reviews to understand better what to expect from the provider. It would help if you also looked for a provider who offers transparent pricing practices and open lines of communication.

Find a tax preparation service provider that meets your needs and budget. A quality service should offer competitive pricing and have flexible payment plans. It should also provide a variety of software packages to suit your unique business needs.

You can reap many benefits if you choose to use professional tax services. These services can assist you in saving valuable time and money and reducing the stress associated with tax preparation. Whether you’re a first-time filer in your 20s, a small business owner trying to grow your business, or a retiree figuring out how to report investment income, a quality tax preparer can simplify the process and ensure that your taxes are filed accurately.

In a competitive market, the ability to deliver exceptional client service can make or break your business. As a result, it’s essential to develop a comprehensive client service plan that outlines your goals and objectives. It will help you differentiate yourself from your competitors and attract more clients. These steps can guide you in establishing a successful tax practice that adds value to your clients in the long term.

Compliance

Keeping up with the changing tax code requires expertise, time, and attention to detail. It’s no wonder that individuals and business owners seek professional help with tax preparation, filing, and compliance.

Whether you’re looking to improve the efficiency of your tax preparation firm or want to launch an online tax prep service, you can make the most of today’s technologies. For example, you can reduce errors with a robust document management system that supports electronic document collection. It enables clients to upload documents directly rather than handing them over in person, making it easier for tax preparers to review documents and enter data.

Another way to ensure accuracy and timeliness is by using a tax software solution that automatically imports data from IRS forms so that you don’t have to enter it manually. Dealing with complicated tax returns can be time-consuming and challenging, but it can save you a lot of money.

Choosing a reliable tax software solution is essential, especially during the busy season. Downtime or unexpected/unresolved errors can hurt client satisfaction and the bottom line of your tax practice.

When choosing a tax software solution, look for one with extensive form support, calculation capabilities, and a comprehensive data import module. It will allow you to complete more complex returns and focus on higher-value work. Automating more processes and reducing manual data entry can minimize errors and speed up processing times.

In addition to the benefits of automation, choosing flexible tax software that offers ongoing support is essential. It will give you peace of mind that your software will be up and running when needed, ensuring you can deliver quality services to your clients.

If you’re considering starting your tax prep practice, take some time to think about your short-term and long-term goals. Consider your ideal customer base, how you’ll market your services, and what types of tax returns you’ll be able to offer. Consider taking a course in tax preparation or attending seminars and workshops on the subject.

Time

The business demands often leave entrepreneurs overwhelmed, especially during tax season. Leaving accounting to professionals can help them spend more time on essential aspects of their business, such as marketing or product/service delivery. In addition, a professional tax services firm is likely more cost-effective than hiring an in-house employee.

When choosing a tax preparation service provider, it’s essential to find one with experience in your industry and expertise in the latest tax laws. Look for a company with multiple payment options and a strong customer support team. Additionally, it’s essential to choose a company that adheres to security protocols, including two-factor authentication, data encryption, and backup.

Empathy, personability, and excellent communication are essential client service skills for any tax professional. But to stand out from the competition and build a thriving business, you must identify your niche and focus on serving clients in that market segment. It will allow you to understand their unique concerns and needs and provide a more personalized approach. Moreover, specialized expertise in certain areas of tax law, such as small business, high-net-worth individuals, and expatriate taxation, will set you apart from the competition and distinguish your brand in the marketplace.

Tax professionals must stay current on tax code changes affecting clients’ finances during tax season. Keeping abreast of these developments will ensure you can efficiently and effectively address your clients’ questions and concerns. In addition, it will also enable you to offer valuable insights and recommendations that will add value to their tax return submissions.

Technology is revolutionizing the way that taxes are filed. Automation, APIs, and AI allow tax professionals to move beyond being mere data processors and become trusted advisors who can provide valuable services to their clients. It includes technologies such as auto verification, which allows machines to verify and index the information in source documents automatically. Other technologies transforming the tax profession include scan-and-populate and work paper solutions and generative AI (like Chat GPT).

By embracing advanced technology, you can streamline your processes, enhance collaboration, and improve efficiency throughout the business process. For instance, a document management solution with features like real-time document synchronization can save you valuable time by reducing paperwork clutter. In addition, the right tax technology can reduce communication barriers and provide an excellent client experience, helping you build long-lasting relationships that will stand the test of time.

Money

Professional tax services offer cost savings to individuals and businesses. They help taxpayers avoid filing errors that could lead to IRS penalties and fines, and they have a keen eye for potential deductions or credits that DIY filers may overlook. Furthermore, they can save clients time by taking over the complicated returns processing and other financial paperwork.

Tax preparers should have strong critical thinking skills and be able to understand complex tax regulations and processes. Additionally, they should be able to communicate well with their clients and other professionals to clarify details. They also need discretion, as they work with sensitive information about their client’s finances and personal life.

The tax preparation process can be overwhelming, especially for business owners with many responsibilities. A tax service provider can save you time and money by handling all the tedious tax forms, maximizing deductions, and filing accurately. They can also provide expert financial advice to keep your business running smoothly.

Research each company’s credentials and reputation when selecting a tax preparation service. Ensure the company is licensed and certified, and ask for references from past clients. It will help you choose a service that meets your needs and budget.

Choosing the right software for your taxes is essential.

In addition to providing time-saving features, a professional tax preparation service should offer security measures for their clients’ sensitive financial information. It includes using secure websites and data encryption protocols to protect data from cyber-attacks. They should also have a reliable IT infrastructure that can support their services.

Entrusting your taxes to a professional tax preparation service can ensure accuracy and compliance with the law, which is crucial for your financial future. Rather than searching for the right software or dealing with the risk of errors, hire a qualified tax professional to handle all your filing needs.

General

The Mating Press Position and its Role in Sexual Wellness

missionary position, involves the male partner assuming a more assertive and dominant role during sexual intercourse. While the missionary position typically features the male partner on top, the Mating Press introduces a heightened sense of aggression, creating a unique dynamic between partners. It is crucial to note that engaging in any sexual activity should be consensual, with open communication between partners to ensure a positive and enjoyable experience.

Physical Mechanics and Dynamics:

Exploring the physical mechanics of the Mating Press position involves understanding the nuances that differentiate it from the traditional missionary position. The position often includes variations in the angle and depth of penetration, providing a different sensory experience for both partners. This physicality may contribute to increased arousal and satisfaction, but it is essential for individuals to be aware of their comfort levels and communicate openly about their desires.

Potential Benefits of the Mating Press Position:

- Variety and Novelty:

The Mating Press position can introduce variety and novelty into sexual relationships, preventing monotony and enhancing overall satisfaction. Experimenting with different positions can contribute to a more fulfilling and exciting intimate connection between partners. - Enhanced Emotional Connection:

Sexual intimacy plays a crucial role in fostering emotional connections between partners. The Mating Press position, with its unique dynamics, may deepen the emotional bond by allowing couples to explore new facets of their relationship. - Increased Physical Stimulation:

The altered mechanics of the Mating Press position can lead to increased physical stimulation for both partners. This heightened sensation may contribute to a more intense and pleasurable sexual experience.

Communication and Consent:

While exploring different sexual positions can be an exciting aspect of a relationship, it is imperative to prioritize communication and consent. Openly discussing desires, boundaries, and comfort levels with a partner is crucial to creating a safe and trusting environment. Consent should be enthusiastic, continuous, and mutual, ensuring that both individuals feel respected and comfortable throughout the intimate encounter.

Potential Concerns and Considerations:

- Physical Comfort and Fitness:

Engaging in more assertive positions, such as the Mating Press, may require a certain level of physical fitness and flexibility. It is essential for individuals to be mindful of their bodies and communicate any discomfort or limitations to their partners. - Emotional Comfort:

Experimenting with new sexual positions can evoke a range of emotions. Partners should be attentive to each other’s emotional well-being and provide support and reassurance as needed.

Conclusion:

The Mating Press position represents one of the many variations in the spectrum of human sexuality. As with any sexual activity, open communication, trust, and consent are paramount to ensuring a positive and enjoyable experience for both partners. Exploring different positions, including the Mating Press, can add excitement and variety to intimate relationships, deepening the emotional connection and enhancing overall satisfaction. It is crucial for individuals to approach sexual experimentation with a mutual understanding of boundaries and a commitment to each other’s well-being. As society continues to evolve, conversations around sexual wellness and exploration become increasingly important, emphasizing the significance of respecting individual preferences and fostering healthy.

General

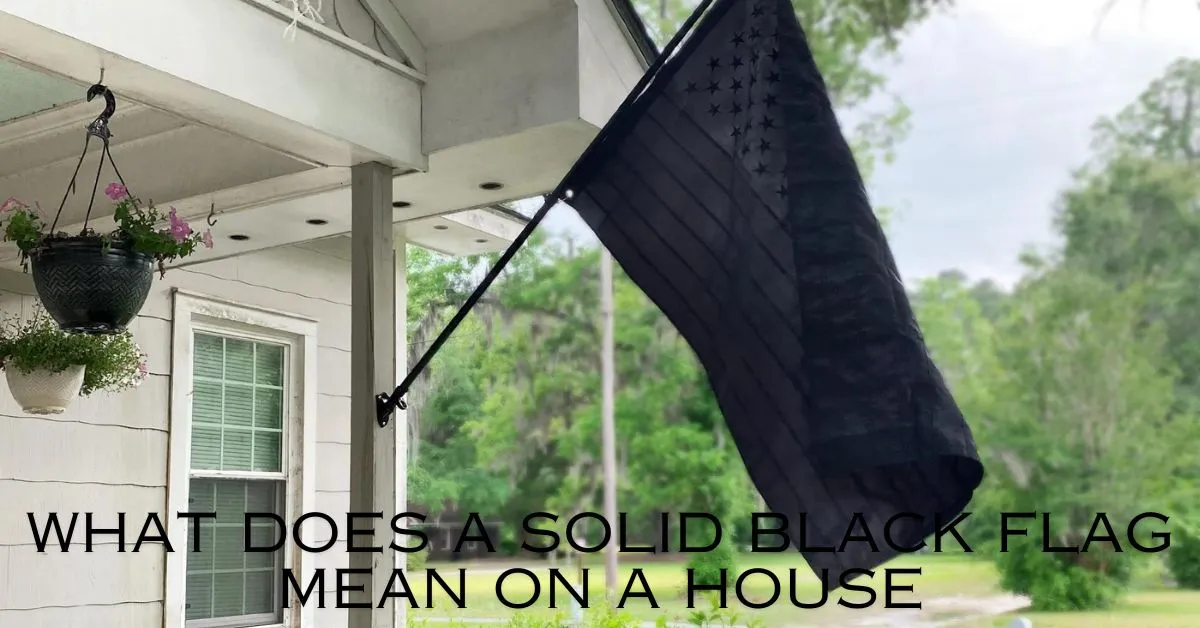

What Does a Solid Black Flag Mean on a House?

In the realm of symbolism, flags serve as powerful communicators of messages, values, and identities. They flutter proudly atop buildings, ships, and even homes, conveying a myriad of meanings. Among the vast array of flags, one might come across a peculiar sight: a solid black flag adorning a house. What could this enigmatic symbol signify? Let us delve into the depths of symbolism to uncover the potential meanings behind the presence of a solid black flag on a house.

The Intriguing Aura of the Black Flag:

Traditionally, flags have been utilized to symbolize nations, organizations, or causes, with each color and design carrying its own significance. However, the presence of a solid black flag on a house veers away from these conventional uses, inviting speculation and curiosity.

Black, as a color, has long been associated with various meanings across different cultures and contexts. Often symbolizing darkness, mystery, or mourning, it carries a sense of solemnity and gravity. When applied to flags, black can take on additional connotations, ranging from rebellion to specific messages of distress or protest.

Historical Context: The Jolly Roger and Beyond

One of the most iconic uses of the black flag is found in the infamous Jolly Roger, the traditional flag of European and American pirates. Featuring a white skull and crossbones atop a black background, the Jolly Roger struck fear into the hearts of sailors and coastal inhabitants during the age of piracy. Its message was clear: danger, lawlessness, and a disregard for authority.

Beyond piracy, black flags have been employed by various groups throughout history to signal defiance, rebellion, or mourning. During periods of political upheaval or revolution, black flags might fly high as a symbol of resistance against oppressive regimes. Similarly, in times of mourning or tragedy, black flags may be raised to express grief and solidarity.

Modern Interpretations: Contemporary Uses of the Black Flag

In contemporary contexts, the meaning of a solid black flag on a house can vary widely, depending on the intentions of the individual or group displaying it. While some instances may harken back to historical symbolism, others may take on entirely new meanings shaped by modern circumstances and ideologies.

One potential interpretation of a black flag on a house is as a symbol of protest or dissent. In an era marked by social and political tensions, individuals or communities may choose to fly black flags as a visual statement of opposition to perceived injustices or grievances. Whether advocating for environmental causes, human rights, or systemic change, the black flag can serve as a powerful emblem of resistance.

Moreover, the presence of a black flag on a house may also indicate a state of mourning or remembrance. In times of personal loss or community tragedy, displaying a black flag can express solidarity with those who are grieving and serve as a visible reminder of the need for compassion and support.

Potential Interpretations and Meanings

Despite its ominous appearance, the solid black flag on a house is not necessarily indicative of malevolent intent. Rather, its meaning is shaped by the context in which it is displayed and the message intended by those who raise it.

For some, the black flag may represent a call to action, urging society to confront pressing issues and work towards positive change. It may serve as a reminder of the complexities of the human experience, encompassing both struggle and resilience in the face of adversity.

In other instances, the black flag may serve as a beacon of solidarity and empathy, fostering connections within communities and offering solace to those in need. Its presence can signify a willingness to confront difficult truths and support one another through times of hardship.

Conclusion: Unraveling the Mysteries of the Black Flag

In the tapestry of symbols that adorn our world, the solid black flag on a house stands out as a potent emblem of meaning and significance. Whether invoking the swashbuckling adventures of pirates or the solemnity of mourning, its presence commands attention and invites interpretation.

While the exact meaning of a black flag on a house may elude easy categorization, its symbolism remains deeply rooted in history, culture, and human experience. Whether signaling defiance, mourning, or solidarity, the black flag serves as a reminder of the complexities of our shared journey and the myriad ways in which we seek to navigate its challenges.

So, the next time you encounter a solid black flag fluttering in the breeze, take a moment to ponder its significance. Behind its enigmatic facade lies a rich tapestry of meanings, waiting to be unraveled and understood.

General

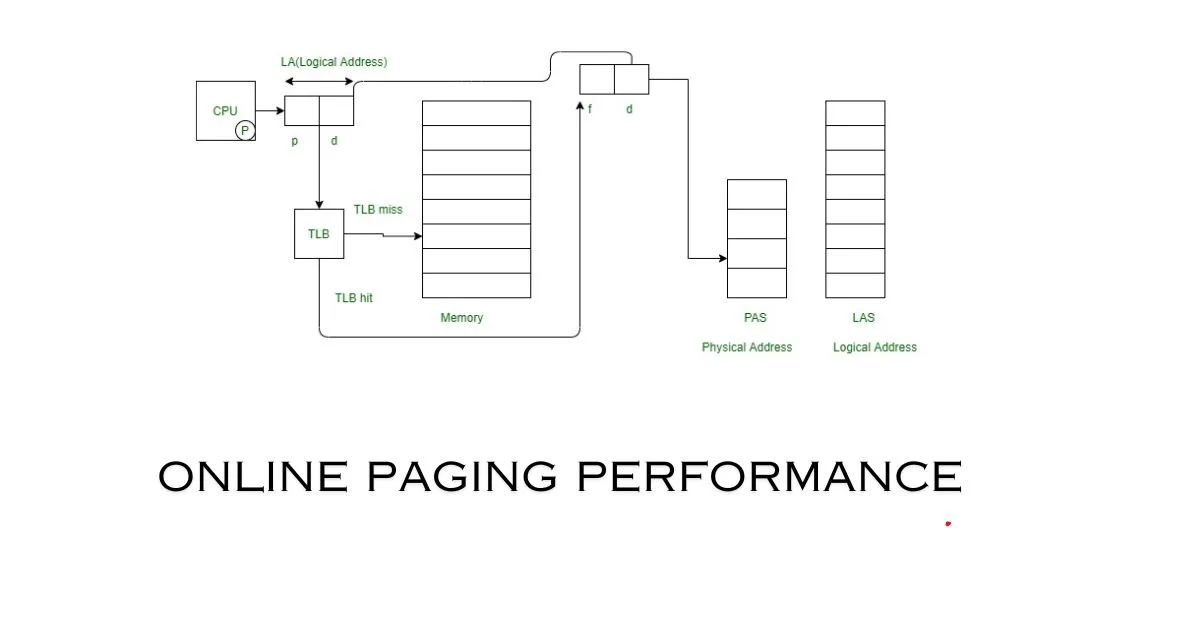

Online Paging Performance: Strategies, Tips, and Best Practices

-

Technology8 months ago

Technology8 months ago社工库: Navigating the Depths of Social Engineering Databases

-

News6 months ago

News6 months agoFinding the Truth Behind a Trails Carolina Death

-

Education7 months ago

Education7 months agoFortiOS 7.2 – NSE4_FGT-7.2 Free Exam Questions [2023]

-

Technology3 months ago

Technology3 months agoAmazon’s GPT-55X: A Revolutionary Leap in AI Technology

-

History & Tradition9 months ago

History & Tradition9 months agoλιβαισ: Unraveling Its Mystique

-

Education8 months ago

Education8 months agoExploring the Significance of 92career

-

News8 months ago

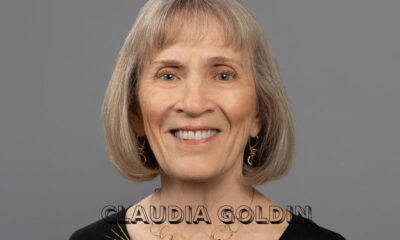

News8 months agoClaudia Goldin: A Trailblazer in Understanding Gender Pay Gap

-

Entertainment7 months ago

Entertainment7 months agoFree Tube Spot: Your Gateway to Endless Entertainment