General

Revalue IQD is live at 3.47 to the USD

In the world of global finance, currencies play a vital role in facilitating trade, investment, and economic growth. Among the myriad of currencies traded on the international market, the Iraqi Dinar (IQD) holds a unique place due to its potential for revaluation. Recently, there has been speculation surrounding the revaluation of the IQD, with rumors circulating that it may be live at 3.47 to the US Dollar (USD). In this comprehensive article, we’ll delve into the intricacies of the IQD revaluation(revalue IQD is live at 3.47 to the USD), exploring its potential implications and what it means for investors, traders, and the Iraqi economy.

Understanding the IQD Revaluation:

The term “revaluation” refers to the process of adjusting the exchange rate of a currency relative to other currencies. In the case of the IQD, a revaluation would involve an increase in its value against the USD and other foreign currencies. This would effectively make the IQD stronger and more valuable in the global market.

The recent speculation surrounding the IQD suggests that it may be revalued at 3.47 to the USD. This would represent a significant increase in value compared to its current exchange rate, which is much lower. While the exact reasons behind this potential revaluation are unclear, it has sparked a great deal of interest and excitement among investors and traders.

Potential Implications of the IQD Revaluation:

The potential revaluation of the IQD at 3.47 to the USD could have far-reaching implications for various stakeholders, including:

- Investors: For investors holding IQD-denominated assets, such as bonds or stocks, a revaluation at 3.47 to the USD would lead to a substantial increase in the value of their investments. This could result in significant gains for those who have invested in the Iraqi economy.

- Traders: Currency traders who speculate on exchange rate movements could stand to profit from the revaluation of the IQD. If the IQD is indeed revalued at 3.47 to the USD, traders who have purchased IQD at lower exchange rates could sell them at the higher rate, realizing a profit in the process.

- Iraqi Economy: A revaluation of the IQD could have both positive and negative effects on the Iraqi economy. On the one hand, it could boost investor confidence and attract foreign investment, leading to increased economic activity and growth. On the other hand, it could also lead to inflationary pressures and a loss of competitiveness for Iraqi exporters.

Factors Influencing the IQD Revaluation:

Several factors could influence the potential revaluation of the IQD at 3.47 to the USD, including:

- Economic Stability: The stability of the Iraqi economy is a key consideration in any decision to revalue the IQD. A revaluation would likely only occur if the Iraqi economy is strong and stable enough to support it.

- Political Factors: Political stability and government policies also play a role in determining the exchange rate of the IQD. A stable and supportive political environment could increase the likelihood of a revaluation.

- Global Market Conditions: External factors, such as changes in global economic conditions or shifts in investor sentiment, could also influence the potential revaluation of the IQD. A favorable global economic climate could increase the likelihood of a revaluation.

Risks and Challenges:

While the potential revaluation of the IQD at 3.47 to the USD presents exciting opportunities, it also comes with risks and challenges. Some of the potential risks include:

- Speculative Activity: Speculation surrounding the IQD revaluation could lead to increased volatility in the currency markets, making it difficult to accurately predict exchange rate movements.

- Inflationary Pressures: A sudden revaluation of the IQD could lead to inflationary pressures in the Iraqi economy, as prices adjust to reflect the new exchange rate. This could erode the purchasing power of consumers and undermine economic stability.

- Political Instability: Political instability in Iraq could derail any plans for a revaluation of the IQD, as investors may be reluctant to commit capital to a country that is perceived as unstable.

Conclusion:

The potential revaluation of the revalue IQD is live at 3.47 to the USD has generated a great deal of interest and speculation in the global financial community. While the exact reasons behind this potential revaluation remain unclear, it could have significant implications for investors, traders, and the Iraqi economy as a whole.

As with any investment opportunity, it’s important to approach the potential revaluation of the IQD with caution and careful consideration of the risks involved. While the prospect of significant gains may be enticing, investors should also be mindful of the potential pitfalls and challenges that lie ahead.

Ultimately, only time will tell whether the IQD will indeed be revalued at 3.47 to the USD. Until then, investors and traders will continue to monitor developments closely, eagerly anticipating any news or updates regarding the future of the Iraqi Dinar and its potential revaluation.

General

The Mating Press Position and its Role in Sexual Wellness

missionary position, involves the male partner assuming a more assertive and dominant role during sexual intercourse. While the missionary position typically features the male partner on top, the Mating Press introduces a heightened sense of aggression, creating a unique dynamic between partners. It is crucial to note that engaging in any sexual activity should be consensual, with open communication between partners to ensure a positive and enjoyable experience.

Physical Mechanics and Dynamics:

Exploring the physical mechanics of the Mating Press position involves understanding the nuances that differentiate it from the traditional missionary position. The position often includes variations in the angle and depth of penetration, providing a different sensory experience for both partners. This physicality may contribute to increased arousal and satisfaction, but it is essential for individuals to be aware of their comfort levels and communicate openly about their desires.

Potential Benefits of the Mating Press Position:

- Variety and Novelty:

The Mating Press position can introduce variety and novelty into sexual relationships, preventing monotony and enhancing overall satisfaction. Experimenting with different positions can contribute to a more fulfilling and exciting intimate connection between partners. - Enhanced Emotional Connection:

Sexual intimacy plays a crucial role in fostering emotional connections between partners. The Mating Press position, with its unique dynamics, may deepen the emotional bond by allowing couples to explore new facets of their relationship. - Increased Physical Stimulation:

The altered mechanics of the Mating Press position can lead to increased physical stimulation for both partners. This heightened sensation may contribute to a more intense and pleasurable sexual experience.

Communication and Consent:

While exploring different sexual positions can be an exciting aspect of a relationship, it is imperative to prioritize communication and consent. Openly discussing desires, boundaries, and comfort levels with a partner is crucial to creating a safe and trusting environment. Consent should be enthusiastic, continuous, and mutual, ensuring that both individuals feel respected and comfortable throughout the intimate encounter.

Potential Concerns and Considerations:

- Physical Comfort and Fitness:

Engaging in more assertive positions, such as the Mating Press, may require a certain level of physical fitness and flexibility. It is essential for individuals to be mindful of their bodies and communicate any discomfort or limitations to their partners. - Emotional Comfort:

Experimenting with new sexual positions can evoke a range of emotions. Partners should be attentive to each other’s emotional well-being and provide support and reassurance as needed.

Conclusion:

The Mating Press position represents one of the many variations in the spectrum of human sexuality. As with any sexual activity, open communication, trust, and consent are paramount to ensuring a positive and enjoyable experience for both partners. Exploring different positions, including the Mating Press, can add excitement and variety to intimate relationships, deepening the emotional connection and enhancing overall satisfaction. It is crucial for individuals to approach sexual experimentation with a mutual understanding of boundaries and a commitment to each other’s well-being. As society continues to evolve, conversations around sexual wellness and exploration become increasingly important, emphasizing the significance of respecting individual preferences and fostering healthy.

General

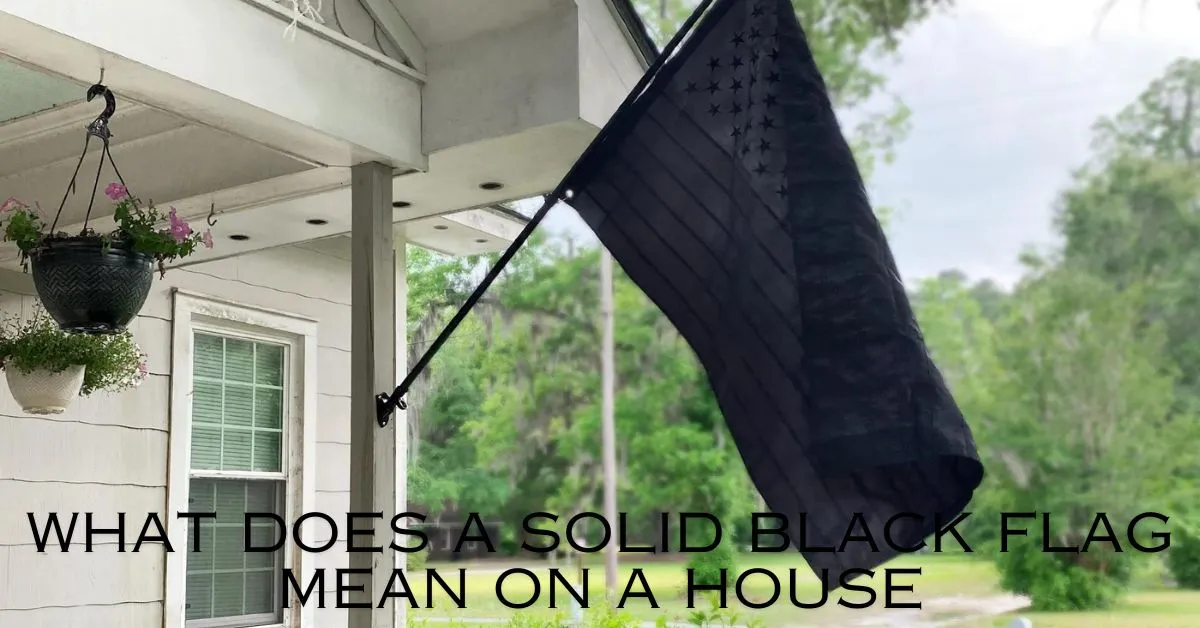

What Does a Solid Black Flag Mean on a House?

In the realm of symbolism, flags serve as powerful communicators of messages, values, and identities. They flutter proudly atop buildings, ships, and even homes, conveying a myriad of meanings. Among the vast array of flags, one might come across a peculiar sight: a solid black flag adorning a house. What could this enigmatic symbol signify? Let us delve into the depths of symbolism to uncover the potential meanings behind the presence of a solid black flag on a house.

The Intriguing Aura of the Black Flag:

Traditionally, flags have been utilized to symbolize nations, organizations, or causes, with each color and design carrying its own significance. However, the presence of a solid black flag on a house veers away from these conventional uses, inviting speculation and curiosity.

Black, as a color, has long been associated with various meanings across different cultures and contexts. Often symbolizing darkness, mystery, or mourning, it carries a sense of solemnity and gravity. When applied to flags, black can take on additional connotations, ranging from rebellion to specific messages of distress or protest.

Historical Context: The Jolly Roger and Beyond

One of the most iconic uses of the black flag is found in the infamous Jolly Roger, the traditional flag of European and American pirates. Featuring a white skull and crossbones atop a black background, the Jolly Roger struck fear into the hearts of sailors and coastal inhabitants during the age of piracy. Its message was clear: danger, lawlessness, and a disregard for authority.

Beyond piracy, black flags have been employed by various groups throughout history to signal defiance, rebellion, or mourning. During periods of political upheaval or revolution, black flags might fly high as a symbol of resistance against oppressive regimes. Similarly, in times of mourning or tragedy, black flags may be raised to express grief and solidarity.

Modern Interpretations: Contemporary Uses of the Black Flag

In contemporary contexts, the meaning of a solid black flag on a house can vary widely, depending on the intentions of the individual or group displaying it. While some instances may harken back to historical symbolism, others may take on entirely new meanings shaped by modern circumstances and ideologies.

One potential interpretation of a black flag on a house is as a symbol of protest or dissent. In an era marked by social and political tensions, individuals or communities may choose to fly black flags as a visual statement of opposition to perceived injustices or grievances. Whether advocating for environmental causes, human rights, or systemic change, the black flag can serve as a powerful emblem of resistance.

Moreover, the presence of a black flag on a house may also indicate a state of mourning or remembrance. In times of personal loss or community tragedy, displaying a black flag can express solidarity with those who are grieving and serve as a visible reminder of the need for compassion and support.

Potential Interpretations and Meanings

Despite its ominous appearance, the solid black flag on a house is not necessarily indicative of malevolent intent. Rather, its meaning is shaped by the context in which it is displayed and the message intended by those who raise it.

For some, the black flag may represent a call to action, urging society to confront pressing issues and work towards positive change. It may serve as a reminder of the complexities of the human experience, encompassing both struggle and resilience in the face of adversity.

In other instances, the black flag may serve as a beacon of solidarity and empathy, fostering connections within communities and offering solace to those in need. Its presence can signify a willingness to confront difficult truths and support one another through times of hardship.

Conclusion: Unraveling the Mysteries of the Black Flag

In the tapestry of symbols that adorn our world, the solid black flag on a house stands out as a potent emblem of meaning and significance. Whether invoking the swashbuckling adventures of pirates or the solemnity of mourning, its presence commands attention and invites interpretation.

While the exact meaning of a black flag on a house may elude easy categorization, its symbolism remains deeply rooted in history, culture, and human experience. Whether signaling defiance, mourning, or solidarity, the black flag serves as a reminder of the complexities of our shared journey and the myriad ways in which we seek to navigate its challenges.

So, the next time you encounter a solid black flag fluttering in the breeze, take a moment to ponder its significance. Behind its enigmatic facade lies a rich tapestry of meanings, waiting to be unraveled and understood.

General

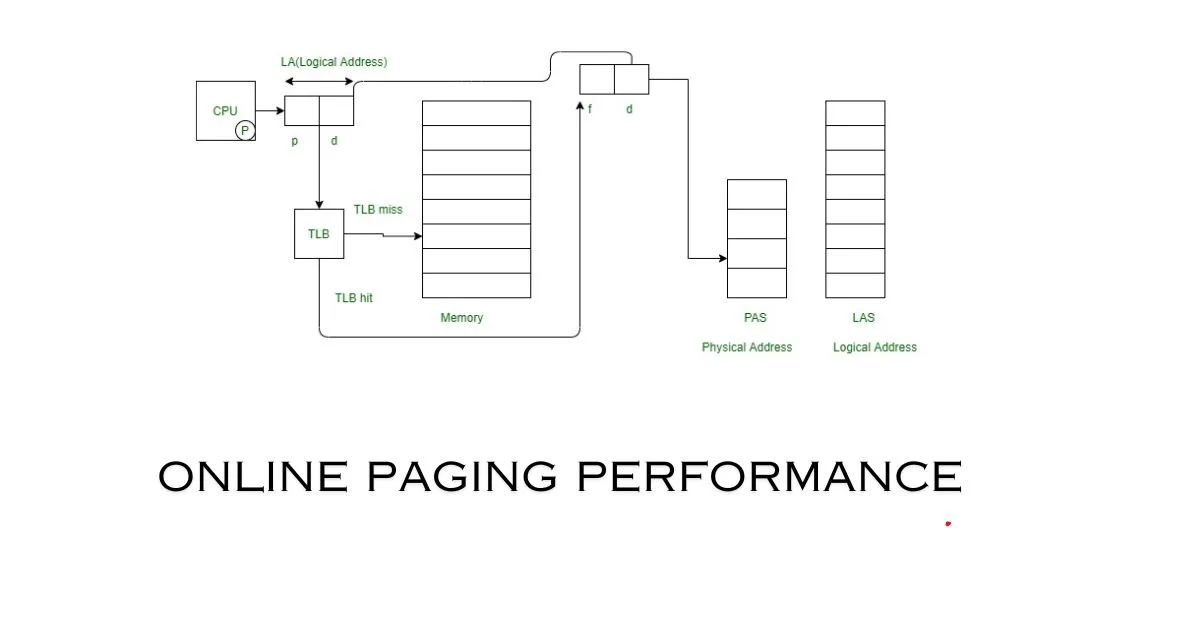

Online Paging Performance: Strategies, Tips, and Best Practices

-

Technology8 months ago

Technology8 months ago社工库: Navigating the Depths of Social Engineering Databases

-

News6 months ago

News6 months agoFinding the Truth Behind a Trails Carolina Death

-

Education7 months ago

Education7 months agoFortiOS 7.2 – NSE4_FGT-7.2 Free Exam Questions [2023]

-

Technology3 months ago

Technology3 months agoAmazon’s GPT-55X: A Revolutionary Leap in AI Technology

-

History & Tradition9 months ago

History & Tradition9 months agoλιβαισ: Unraveling Its Mystique

-

Education8 months ago

Education8 months agoExploring the Significance of 92career

-

News8 months ago

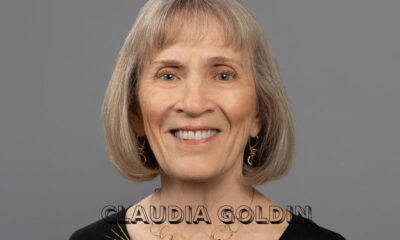

News8 months agoClaudia Goldin: A Trailblazer in Understanding Gender Pay Gap

-

Entertainment7 months ago

Entertainment7 months agoFree Tube Spot: Your Gateway to Endless Entertainment